How To Write A Donation Receipt

Proper receipts are equally as vital when it comes to donations of products and. The donation receipt may be issued by your charity organization or group to document the receipt of a donation.

501c3 Tax Deductible Donation Letter Donation Letter Template Donation Letter Receipt Template

Donation receipt sample letter is the acknowledgment letter for receiving the amount of donation that you asked for either in the form of money or in kind.

. Any gift over 250 must be recognized with a receipt. Its essential to have your own filing system. The text receipt should include all basic information such as your organizations name the amount of the.

To do this make sure you include your charity information their name a summary of their contributions the total for their contributions and your signature. Remember Donations of Goods Services. Keep Your Donation Receipts and Thank You Letters Separate.

Sending a text receipt is another way thank donors for their support. A 501 c 3 donation receipt is required to be completed by charitable organizations when receiving gifts in a value of 250 or more. Donation receipts for donated vehicles work in two ways.

Its utilized by an individual that has donated cash or payment personal property or a vehicle and seeking to claim the donation as a tax deduction. The name of your organization. 2 if you end up using it you need to mention why youre doing so and how long you would in the donation receipt.

Make sure of your donor and only write his her or their name in your donation receipt. This includes the date when the letter is being written as well as the address of the recipient of the letter. Include a notice of receipt.

Your contributors should be able to rapidly scan the receipt for the information they. If you ever need proof of a donation a copy of a receipt or to reissue a receipt your filing system will be your best friend. How To Write A Great Donation Receipt For Your Nonprofit.

Start with the heading. You will want to list the cash amounts donated as well as the type of products or services donated to your charity. Description but not value of non-cash contribution.

It needs to include the information that the donor needs to file their taxes. Make sure you and all the members of your organization know the rules of correct receipting. Text Receipt for Donations.

Amount of cash contribution. Name of the organization. We recommend that you use a donor management system that has an automatic receipt feature built in.

Put your organizations tax ID number. Make Use of. Often a receipt detailing the extent of all donations over the course of the year.

Ad Stay organized and look professional with our online tool. Our site shows when receipts are sent viewed by your customer and accepted or declined. Keeping track of the donation receipts youve issued just makes good sense and keeps everything in order.

With this tax deductible donation receipt template you can. 1 If you sell the vehicle you need to mention the date of sale and the total profits that you made in the donation receipt. Many non-profits try to combine their donation receipt with their thank you letter.

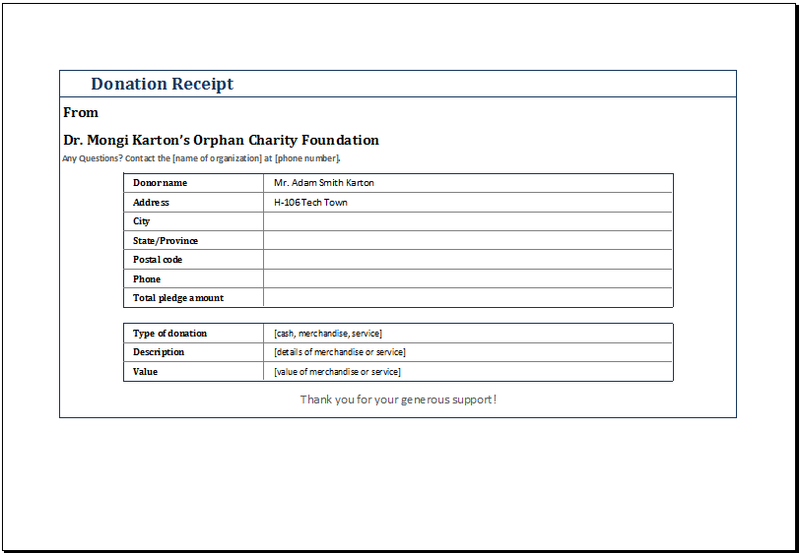

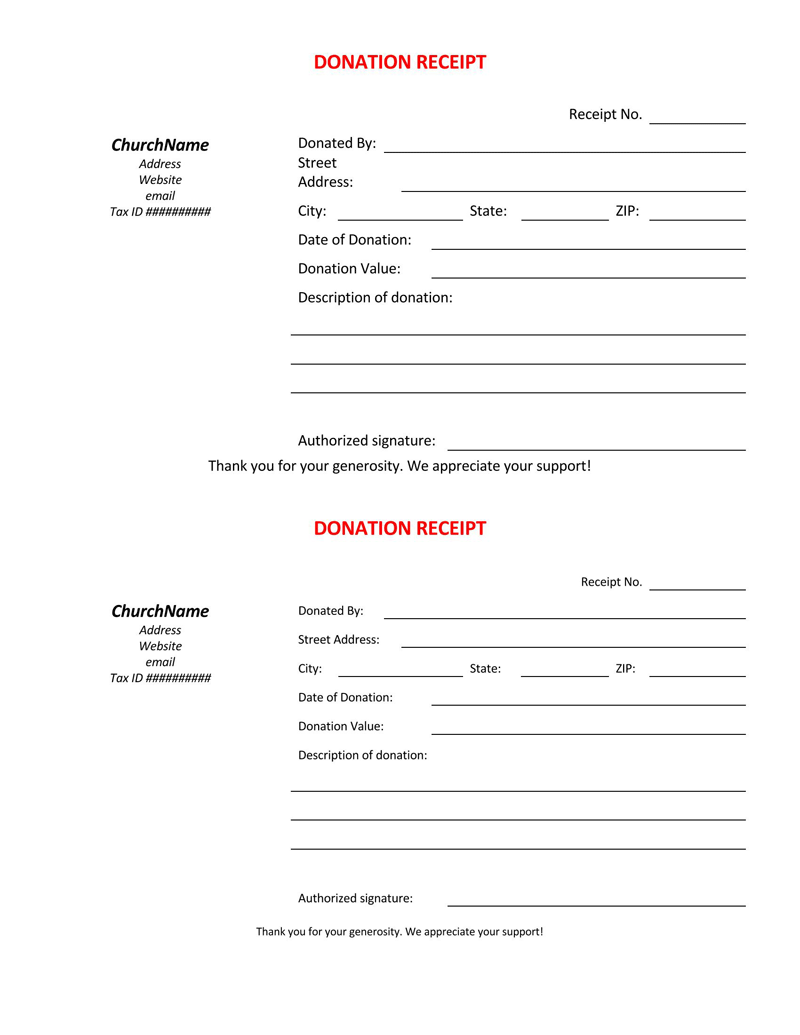

Include stock text with fill-in-the-blank spots for donor name donation date and amount and description of the contribution. This is a letter thanking the person or the organization and at the same time acknowledging the person that you have received the needful. Add your organization logo and name.

A donation tax receipt is essential for your organization and donors and they ensure youre maintaining good relationships with your donors. The Leading Online Publisher of National and State-specific Legal Documents. Your organizations federal tax ID number and a statement indication your organization is a registered 501 c 3 The date of the donation.

Sometimes organizations like to add their logo or tagline to the heading of the letter as well. Likewise most letters this letter also starts with heading. Registered charities and other qualified donees can use these samples to prepare official donation receipts that meet the requirements of the Income Tax Act and its regulations.

This offers an immediate response and you can provide a link for the donor to download a more detailed donation receipt for their records. Here are the steps to follow for writing a donation receipt letter. Ad Download Or Email ACS Forms More Fillable Forms Register and Subscribe Now.

Statement that no goods or services were provided by the organization if that is the case. Store copies of donation receipts. A charitable donation receipt is a letter email message or receipt form notifying a donor that their gift has been received.

Useful Practices When Writing Donation Receipts Keep the Formatting Simple. The letter should state exactly what you received the worth of the item or the total amount when you received the donation and. Ad Download Or Email ACS Forms More Fillable Forms Register and Subscribe Now.

It is a good practice to draft a letter acknowledging thankfulness for. Your donation receipt has a job to do. The name of the donor.

This is a mistake. Charitable donation receipts contain any and all information regarding the gift donor name organization name gift amount gift type etc. The name of your organization.

The heading includes the date when you wrote the letter and the recipients address. The name of the donor. Insert your organization address with contact details including email and website.

A sincere thank you to your donor. Just like all letters a donation receipt letter should start with a heading. The amount given OR a.

How do I write a receipt for a donation. Personalization using merge tags which automatically pull a donors name organization info and transaction info into the receipt. This document provides information about the transaction such as the date and amount of donation who received it eg organization name and any other explanations for why it is presented eg in honor of or a title of the organization.

This will make sure that youre staying compliant with tax receipt regulations without having to. Form donation acceptance policies for your organization and make them transparent for all members and possible benefactors. The website address is canadacacharities-giving.

Official donation receipts must include the name and website address of the Canada Revenue Agency CRA. The receipt template is a Microsoft Word document so that you can customize it and make it work for your organization. To serve both these purposes your donation receipt should contain the following information.

The first paragraph should mention the notice of receipt addressed to the donor. While it is only legally required to send a donation receipt for gifts above 250 its best to send an individual receipt for every donation. You may add your organizations tagline or logo in order to make the letter look more professional.

The written acknowledgment required to substantiate a charitable contribution of 250 or more must contain the following information.

Free Donation Receipt Templates Silent Partner Software

Donation Receipt Template Pdf Templates Jotform

Free 12 Donation Receipt Forms In Pdf Ms Word Excel

Free Donation Receipt Template 501 C 3 Word Pdf Eforms

Free Cash Donation Receipt Pdf Word Eforms

Free Donation Receipt Template 501 C 3 Word Pdf Eforms

Donation Receipt Template Download Printable Pdf Templateroller